Structured products: 2011 year-end market review

(Jan 2012)

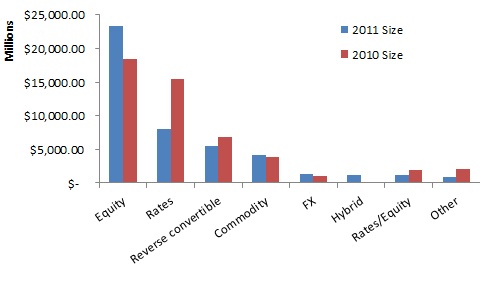

2011 was another big year for structured product sales both in the US and abroad. According to Bloomberg's year end totals, almost $45.5 billion worth of SEC registered structured products were sold in the US in 2011, down only slightly from $49.4 billion in 2010. There were 7,293 individual products sold, up from 6,443 a year earlier.

The number of products linked to interest rates decreased, which was made up for with increases in products linked to equity assets.

Sales in Europe grew...

What are 'structured products', anyway?

(Jan 2012)

By Tim Husson, PhD

We've done a lot of work on structured products. And I mean a lot. In addition to our research on valuation and suitability issues, we've devoted a section of our website to informing investors about different types of products, as well as Tear Sheets evaluating several thousand structured products released over the past couple years. We have found that most structured products are issued at a substantial premium, and that many investors (especially retail investors) do...

Welcome to the new SLCG blog

(Jan 2012)

At SLCG we encounter a lot of complex investment strategies and interesting financial products. We have traditionally written up our findings into research articles and published them in peer-reviewed academic journals, but lately we've realized that there are too many interesting topics to devote an entire research project to each and every one.

We support the dissemination of information that can inform and educate everyday investors of both old and new financial products. It would be...

SLCG Study on Competitiveness of Canadian Market for Securities

(Jun 2011)

Investment Industry Association of Canada Releases SLCG Study on Competitiveness of Canadian Market for Securities Data

SLCG was recently hired by the Investment Industry Association of Canada (IIAC) to investigate and write a report about the competitiveness in the market for securities data in Canada.

Canadian securities data costs have more than doubled since the mid-1990s. The IIAC alleged that these costs increases were not due to any improvement in technology or quality. SLCG...